If you’re deciding between the Canadian Dental Care Plan or Individual Dental Insurance, it depends on your income and dental needs. The CDCP offers affordable essential care for those without private coverage, while private plans provide broader options for cosmetic and advanced treatments. If you’re looking for a CDCP Dentist in Langley, this blog post is for you, as we’ll cover costs, coverage, eligibility, and how to choose the best fit for you.

Canadian Dental Care Plan (CDCP)

In short, the CDCP is a federal government dental plan that aims to reduce the cost of dental care for low-income families. According to government statistics, more than 3.4 million people were approved for the CDCP in its first year of operation, and about 1.7 million people used dental services. Starting in May 2025, all eligible individuals will also be able to participate in the plan.

Covered Services

CDCP pays for a portion of the cost of a variety of essential dental services, including:

- Diagnostic and preventive: Routine checkups, dental x-rays, scaling, fluoride, and sealants.

- Basic restorative: Temporary and permanent Dental Fillings, simple treatments to treat tooth decay and pain.

- Major restorative: Making and repairing crowns (coverings) and other more serious restorations, and removable prostheses such as complete or partial dentures.

- Oral surgery: Tooth and root extractions, surgery for tumors or cysts, drainage of pus, treatment of jaw fractures, and other oral surgeries.

- Sedation and anesthesia: From simple local anesthesia to deep sedation (with prior authorization) during complex treatments.

- Orthodontics: Starting in 2025, orthodontic services will be covered only when medically necessary (and with a limited cost limit).

However, services such as cosmetic procedures, dental implants, and fixed dentures are usually not covered.

✔️ For more information on this, check out the post “What’s Covered by the CDCP in 2025?“

Are you eligible for the Canada Dental Care Plan? (CDCP Eligibility)

The Canada Dental Care Plan has specific entry criteria that must be met. To be eligible for the CDCP, you must meet the following three basic requirements at the same time:

1. Residency and Taxation

You must be a resident of Canada for tax purposes and have completed your previous year’s tax return. If you and your spouse did not file your tax return correctly and on time, you will not be able to apply for this plan.

2. Household Net Income Limit

Your Adjusted Family Net Income must be less than $90,000 per year. It is very important to know that this includes your income plus the income of your spouse or common-law partner. The government calculates your household net income by deducting certain items, such as income from child care benefits or disability savings plans (RDSP).

3. No Access to Any Private Dental Insurance

This requirement is a red line for the CDCP. You must not have any dental coverage from private or employer sources. This includes coverage through your employer or the employer of a family member, coverage through retirement benefits, and coverage through individual plans purchased by you or a family member.

✔️ Are you wondering about the current status of your CDCP application? Check out our Canadian Dental Care Plan Status Checker Online.

How much of the costs does the government cover in the CDCP plan?

The amount of the CDCP government payment varies depending on your family income. The table below illustrates this well.

| Adjusted Family Net Income | Government Share (CDCP) | Individual Share (Out-of-Pocket) | Additional Notes |

| Less than $70,000 | 100% | 0% | The government covers the full cost of all eligible services based on CDCP fee guides. |

| $70,000 – $79,999 | 60% | 40% | The individual pays a portion of the cost according to CDCP rates. |

| $80,000 – $89,999 | 40% | 60% | The individual’s share increases, but a significant subsidy from the government still applies. |

| Over $90,000 or has private dental insurance | — | — | Not eligible for CDCP coverage. |

💡 Note: If the actual treatment cost exceeds CDCP’s established fee guide or you choose a service not covered by the plan, you’ll need to pay the difference yourself. CDCP has no annual dollar limit, but some services have frequency limits (e.g., number of cleanings per year).

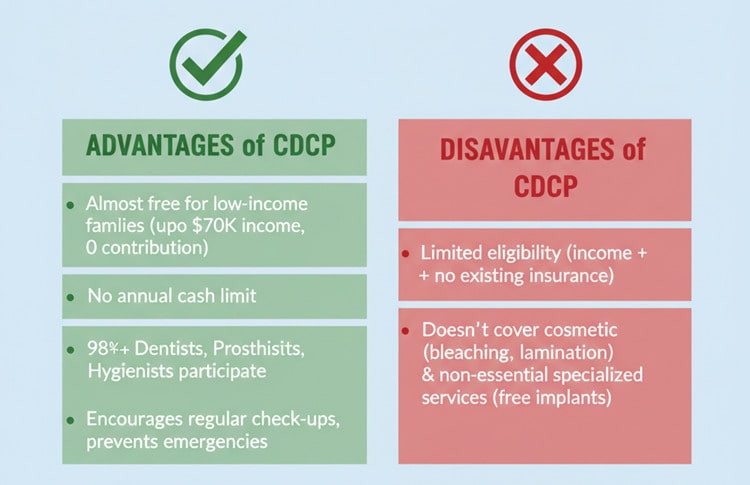

Advantages and Disadvantages of CDCP

Some of the advantages and disadvantages of this health insurance plan include the following:

Advantages of CDCP

It is almost free for low-income families (up to $70,000 in income, where your contribution is zero) and has no annual cash limit. More than 98% of dentists, prosthetists, and dental hygienists in Canada participate in this plan. The implementation of CDCP has encouraged more people to have regular check-ups and prevented emergency dental visits.

Disadvantages of CDCP

Only those who meet the income requirements and lack access to insurance can participate; otherwise, they must use private insurance. Also, cosmetic services (such as bleaching or lamination) and many non-essential specialized services (such as free implants) are not covered.

✔️ If you want to learn how to apply for CDCP, check out the post “How to Apply for CDCP”.

Private Individual Dental Insurance (PDI)

Private Individual Dental Insurance (PDI) is a financial product offered by companies such as Manulife, Sun Life, Blue Cross, and others. Unlike CDCP, which has no monthly premium, PDI requires a fixed premium. Typically, the cost ranges from $20 to $50 per month for an individual and $80 to $150 per month for a family. This cost is fixed, regardless of whether you use the coverage or not.

Covered Services

Preventive services such as regular checkups and scaling are covered by most plans for little or no cost. Services such as fillings, extractions, and root canals usually cover about 50–80% of the cost. Crowns and other more complex services may have coverage limits. Most basic plans do not cover cosmetic services (bleaching, veneers, etc.).

Advantages and Disadvantages of PDI

The pros and cons of PDI include the following:

Advantages of PDI

PDIs, especially in advanced plans, cover major services like crowns and implants at 50%, while CDCP either excludes these services or covers them as very limited removable prostheses. So, if your needs go beyond fillings and root canals, PDI offers more comprehensive coverage.

Disadvantages of PDI

Most private plans have a dollar cap of $1,000 to $2,000. Once your eligible expenses reach this cap, even if you had 50% coverage for a crown, the insurance company will not pay anything for the rest of the year, and you will be responsible for all subsequent expenses.

Comparison Table: CDCP vs. Private Dental Insurance

| Comparison Criteria | Canadian Dental Care Plan (CDCP) | Private Dental Insurance |

| Enrollment & Activation | Registration through CRA; eligibility verification may take a few weeks. | Purchase and activation are immediate; usually available for use right away. |

| Eligibility | Only for individuals/families with an adjusted net income under $90,000 and no existing dental coverage. | Available to everyone (with monthly premium payments). |

| Monthly Premium | None. | Typically between $30 and $100 per month, depending on coverage level. |

| Co-payments | Based on income: government covers 40%–100% of eligible costs. | Usually covers 50%–80% of dental treatment costs. |

| Deductible | None. | Usually between $25 and $100 per year. |

| Covered Services | Essential care: exams, cleanings, fillings, extractions, dentures, and root canals. | Basic and advanced care: includes implants, veneers, whitening, and cosmetic orthodontics. |

| Annual Coverage Limit | No dollar limit (but frequency limits for some services apply). | Typically between $1,000 and $2,000 per year. |

| Choice of Dentist | Limited to clinics that accept CDCP. | Freedom to choose any dentist or clinic (depending on the plan). |

| Wait Times for Services | May take longer, especially in smaller communities. | Usually shorter; depends on the plan and clinic availability. |

| Best For | Low- to middle-income individuals or families without private insurance. | Higher-income individuals or those seeking cosmetic or elective dental treatments. |

Need Personalized Dental Care?

At My Dentist Langley, we provide complete dental exams, cleanings, and personalized treatment plans to keep your smile healthy and confident. Call us today to book your appointment and take charge of your oral health!

Which option is best for you?

If you’re still not sure which option (CDCP or private insurance) is best for you, let’s take a look at which makes more sense for each group of people

If you’re a low-income family:

The CDCP plan is the best option. It covers most essential dental expenses without a monthly premium. It’s a great value, especially if your family income is under $90,000 and you don’t have private insurance.

If you’re retired:

Many retirees lose their company dental insurance after they leave their jobs. In this case, CDCP can help you save money on basic expenses. But if you’re looking for cosmetic services like implants or veneers, might you consider private insurance?

If you’re an employee and have insurance through your company:

In this case, you’re no longer eligible for CDCP. But don’t worry, because company insurance usually has a wider range of coverage, and it’s easier to find a dentist.

If you’re a freelancer or business owner:

Your choice depends on your income. If you earn less than $90,000 a year, CDCP can be a big help. But if you earn more and want more comprehensive services (like orthodontics or cosmetic dentistry), private insurance is a better option.

If you’re a student:

Students usually don’t earn a lot, so CDCP is a more affordable option. Of course, some universities also have their own student dental insurance that may cover some of the costs or even replace CDCP.

Make an Informed Choice Between CDCP or Individual Dental Insurance

Choosing between the Canadian Dental Care Plan and Individual Dental Insurance depends on whether you value affordability or flexibility. CDCP suits households under $90,000 without private coverage, while some private insurance covers advanced or cosmetic care like implants and orthodontics under certain conditions. Knowing both options helps you match dental care to your budget and long-term needs. For exams, cleanings, or restorative treatments, our General Dental services provide complete care for lasting oral health.

FAQ

Can I use both the CDCP and employer dental insurance at the same time?

No, if you have access to any private dental insurance, you are not eligible for CDCP. CDCP is designed for those without any private coverage.

If my income changes during the year, will my CDCP coverage also change?

Yes, CDCP coverage is calculated based on your adjusted family net income. If your income increases and you move into a higher tier, your coverage percentage decreases, and your co-payment increases.

Does CDCP cover dental emergencies outside the approved services?

Generally, CDCP only covers essential and eligible dental services. Coverage for emergencies outside the program is limited. It’s best to confirm with your dental clinic beforehand.

What documents are needed to prove eligibility for CDCP?

Required documents include your Social Insurance Number (SIN), last year’s tax return, date of birth, and income details for you and your spouse. These documents are necessary to verify income and lack of private dental coverage.

Can children or people over 64 use CDCP, or is there an age limit?

Yes, CDCP was initially rolled out for children under 18 and seniors 65 and older, and the full program for adults aged 18–64 is expanding. There is no strict age limit, but coverage is being implemented in phases.

Have you tried the Canadian Dental Care Plan, or do you rely on private dental insurance? Share your experience or questions in the comments below. Your story could help others choose the right option for their dental care!